Top-up by Google Pay allows your customers to top-up IBAN opened at ConnectPay by Google Pay’s digital wallet.

Stage:

To start testing this service, drop a message to [email protected] mentioning you will want to integrate Top-up by Google Pay API. By default, this service is disabled for merchants.

Production:

To receive this service, you will need to have BaaS contract – just inform your account manager about it, as top up is disabled by default.

Prerequisite:

- You will need to receive merchant identifier from us. Just call our Google Pay credentials API using your brand ID.

Google Pay top-up payments are settled instantly, you don’t need to wait as it is for commercial transactions.

Flow:

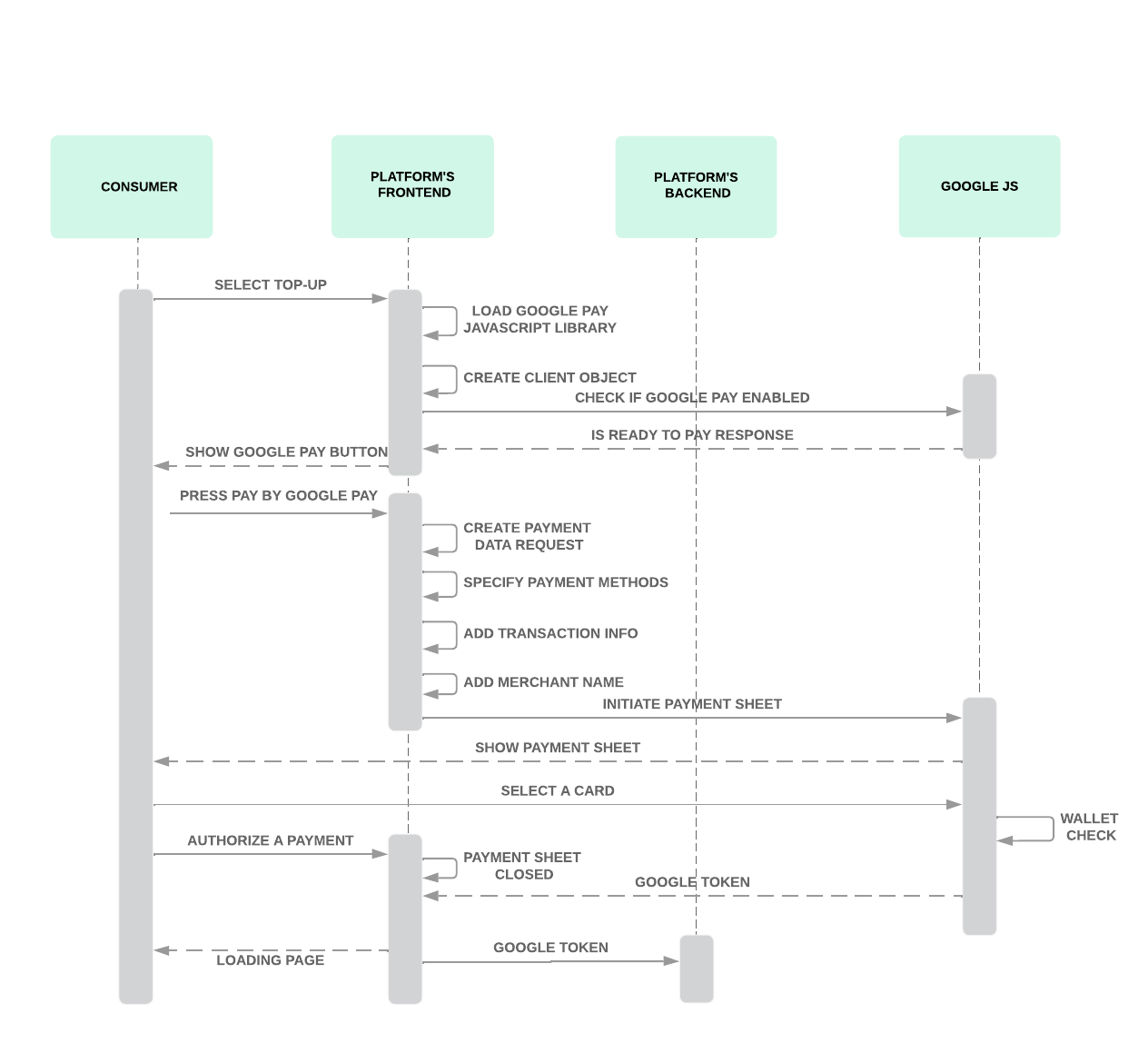

Integration can be split in two parts – wallet validation together with payment sheet creation and payment initiation.

- When your end-user selects to top-up by Google Pay, you will need to load the Google Pay API JS Library in your frontend. Sample below:

<script

async

src="https://pay.google.com/gp/p/js/pay.js"

onload="console.log('TODO: add onload function')">

</script>- After the Google Pay API JavaScript library loads, initialize a

PaymentsClientobject. InmerchantInfoaddmerchantInfoobject received from Google Pay credentials API response. In a non-prod environment dummy payment methods are returned that are suitable to reference the structure of a payment response. In this environment, a selected payment method isn’t capable of a transaction. Please see the sample below:

const paymentsClient =

new google.payments.api.PaymentsClient({{

environment: "TEST",

merchantInfo: {

merchantName: "Example Merchant",

merchantId: "12345678901234567890"

},});Tip! Google recommends only initialize paymentsClient once. Use the same instance when you invoke all of the other APIs, like CreateButton, IsReadyToPay, PrefetchPaymentData, and LoadPaymentData.

- Then, you’ll need to call

isReadyToPay()to determine if the Google Pay API is supported by the current device and browser for your specified payment methods Add your allowed payment methods to your base request object. IntokenizationSpecificationaddtokenizationSpecificationobject received from Google Pay credentials API response. At ConnectPay, we support both VISA and MASTERCARD. See the following code sample:

const baseRequest = {

apiVersion: 2,

apiVersionMinor: 0,

};

const allowedCardNetworks = ['MASTERCARD', 'VISA'];

const allowedCardAuthMethods = ['PAN_ONLY','CRYPTOGRAM_3DS'];

const baseCardPaymentMethod = {

type: 'CARD',

parameters: {

allowedAuthMethods: allowedCardAuthMethods,

allowedCardNetworks: allowedCardNetworks,

assuranceDetailsRequired: true,

},

tokenizationSpecification: {

type: 'PAYMENT_GATEWAY',

parameters: {

gateway: example,

gatewayMerchantId: exampleGatewayMerchantId

}

}

};const isReadyToPayRequest = Object.assign({}, baseRequest);isReadyToPayRequest.allowedPaymentMethods = [baseCardPaymentMethod];paymentsClient.isReadyToPay(isReadyToPayRequest)

.then(function(response) {

if (response.result) {

// add a Google Pay payment button

}

})

.catch(function(err) {

// show error in developer console for debugging

console.error(err);

});- Add a Google Pay payment button to your page. For more information about available button types, colors, and display requirements, see Google Brand guidelines. Google is strict in following their guidelines, please pay attention to it. Incorrect interpretation of branding might cause top-up feature restrictions.

- Then

PaymentDataRequestshould be created. To create aPaymentDataRequestobject, complete the following steps:

- Build a JavaScript object that describes your site’s support for the Google Pay API. For a full list of supported properties, see the PaymentDataRequest structure in Google documentation. You can decide whether you use both

authMethodsor only one. We recommend you support both to suggest this feature to more users.

PAN_ONLY: This authentication method is associated with payment cards stored on file with the user’s Google Account. Returned payment data includes personal account number (PAN) with the expiration month and the expiration year. This method forces 3DS authorization, which we support.CRYPTOGRAM_3DS: This authentication method is associated with cards stored as Android device tokens. Returned payment data includes a 3-D Secure (3DS) cryptogram generated on the device.

See the following code sample:

const paymentDataRequest = Object.assign({}, baseRequest);- Add the payment methods supported by your app, such as any configuration of additional data that’s expected in the response. See the following code sample:

paymentDataRequest.allowedPaymentMethods = [cardPaymentMethod];- Define a total price and currency for a shopper to authorize. You must include the

countryCode,totalPrice, andmerchantNameparameters to meet SCA requirements. See the following code sample:

paymentDataRequest.transactionInfo = {

totalPriceStatus: 'FINAL',

totalPrice: '123.45',

currencyCode: 'EUR',

countryCode: 'LT'

};- Provide a user-visible merchant name, and use Google

TESTmerchantIdvalue when inTESTenvironment. See the following code sample of a user-visible merchant name:

paymentDataRequest.merchantInfo = {

merchantName: 'Example Merchant'

merchantId: '12345678901234567890'

};- Then payment sheet initialization should start. To register an event handler for user gestures, complete the following steps:

- Register a click event handler for the purchase button. The event handler calls

loadPaymentData()immediately after it interacts with the Google Pay, payment button. - After a Google user grants permission for your site to receive information about the user’s selected form of payment and optional contact data, handle the response from the Google Pay API.

- Extract the payment token from the

paymentDataresponse. You will be using gateway integration; pass this token to our Initiate Google Pay API without any modifications.

Note! In a TEST environment, a payment response includes summary data about the selected payment method that’s suitable for display on a confirmation page. The payment response doesn’t include a payment method that’s capable of a transaction.

paymentsClient.loadPaymentData(paymentDataRequest).then(function(paymentData){

// if using gateway tokenization, pass this token without modification

paymentToken = paymentData.paymentMethodData.tokenizationData.token;

}).catch(function(err){

// show error in developer console for debugging

console.error(err);

});

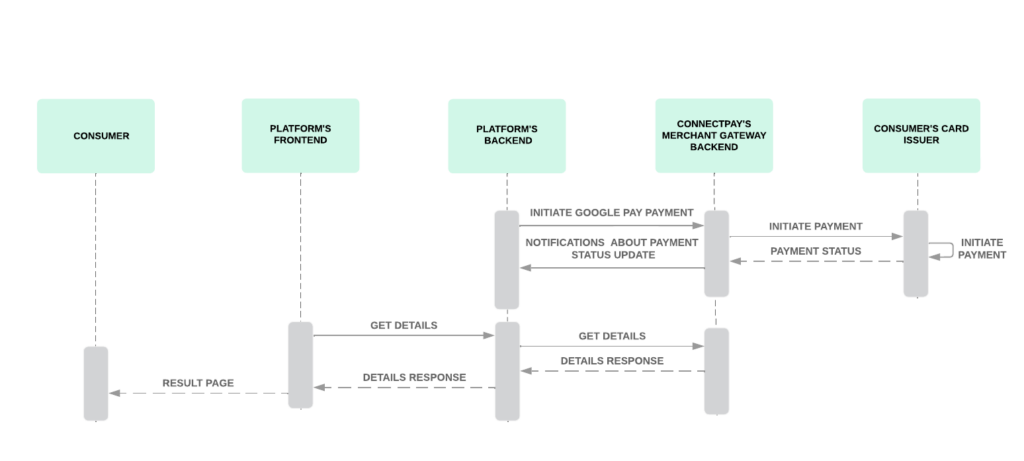

- When you send us an Initiate Google Pay API request and there is

CRYPTOGRAM_3DSselected asauthMethoda process is shorter. As Google takes a liability shift here, the end-user authorizes a payment on an Android device using biometrics, everything happens on the same page and after we receive payment status update, we send you a notification about the payment status change. Initiate Google Pay API returns payment ID as a response, which you can map with payment status change notification response. More about notifications can be found here. - Notifications are optional, so if you don’t want to receive them, you can always call our Get payment details API to receive status on your own.

- After status is successful, you will need to show your end-user result page specifically mentioning that this payment was initiated by Google Pay method.

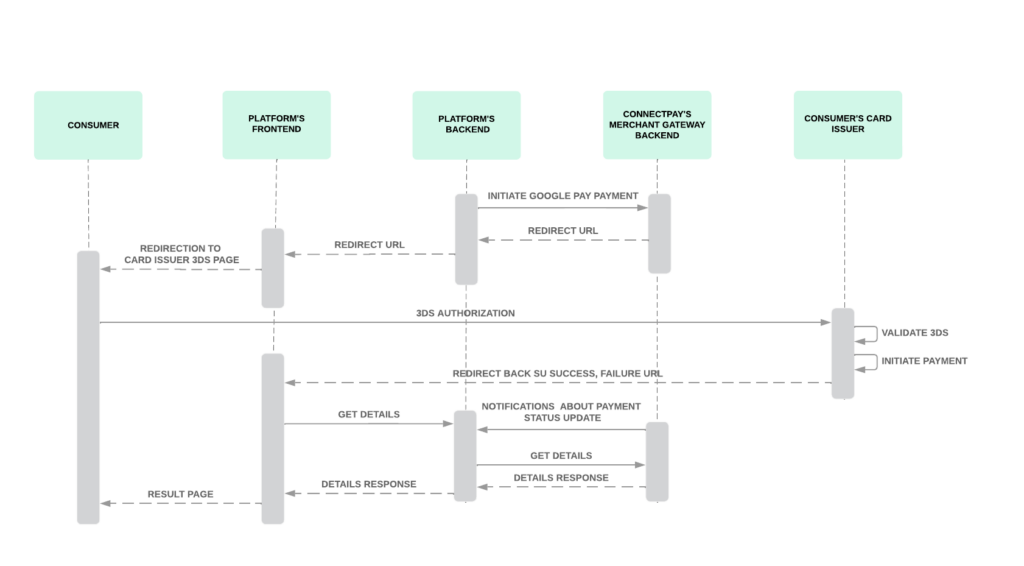

- When you send us an Initiate Google Pay API request and there is PAN_ONLY selected as authMethod, you will receive redirectUrl in response. Redirect your end-user to that URL, and they will perform 3DS authorization.

- After 3DS authorization, based on the result, we will redirect your user back to

successUrlorfailureUrlprovided by you in Initiate Google Pay API request. For security reasons, those URLs should be saved to your devApp too. - After redirection, the process is the same as with

CRYPTOGRAM_3DSflow – we can send you status change notifications, or else you can call our Get payment details API instead.