In general, think of the Developer application (a.k.a., DevApp) as a container that stores your API access configuration:

- Credentials

- Selected ConnectPay API products

- List of Callback URLs (successUrl, failureUrl, dropUrl, redirectUrl parameters used in API request)

- BrandId

- etc

Create an Account in the Developer Portal

- Navigate to the ConnectPay Developer Portal.

- Select the Sign In menu item and click Create account.

- Fill in the required details and follow the instructions to set up two-factor authentication.

List DevApps

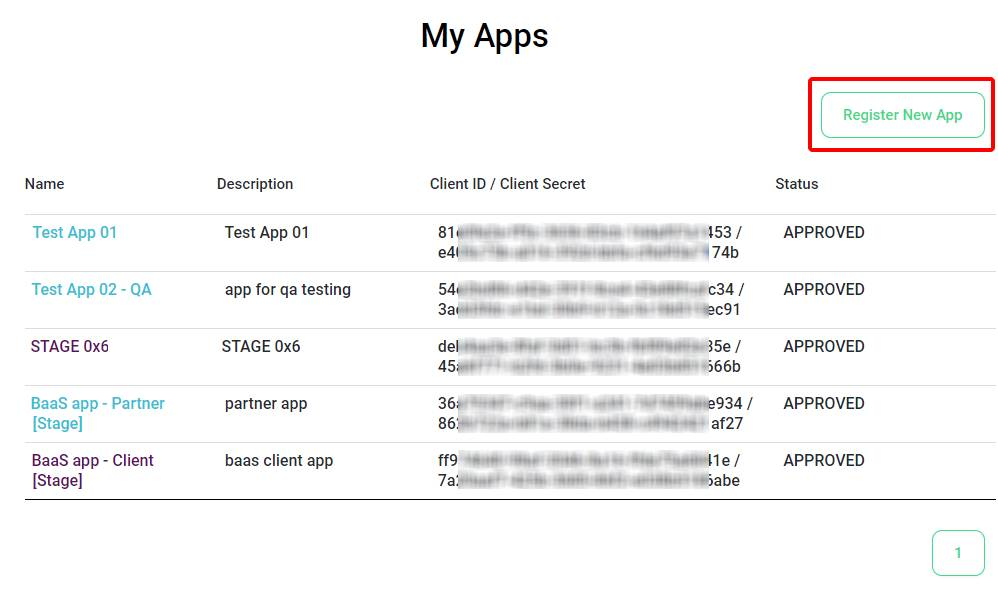

To access DevApps, log into DevPortal, click DevTools in the Menu bar, and select the My Apps item:

The My Apps page will open with list of your DevApps that can be used to access ConnectPay APIs. Click on desired DevApp to edit/view its configuration.

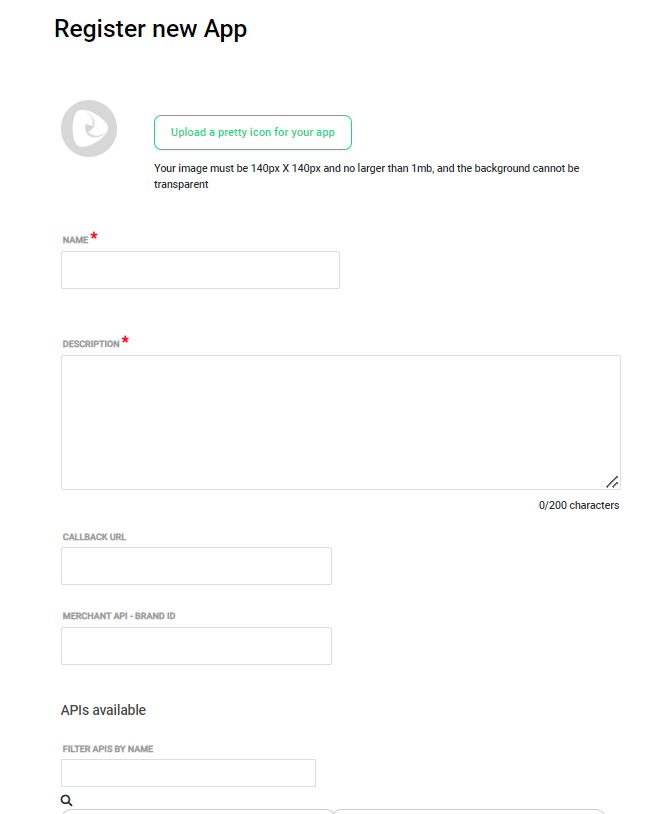

Create New DevApp

While on the above-mentioned My Apps page, press the Register New App button.

- Enter Name.

- From the API Available list, select the API products that you want to use.

Always add SYSTEM SERVICES, AUTH (MTLS) and AUTH (TLS) APIs.

Note: You will be able to modify API list at any time.

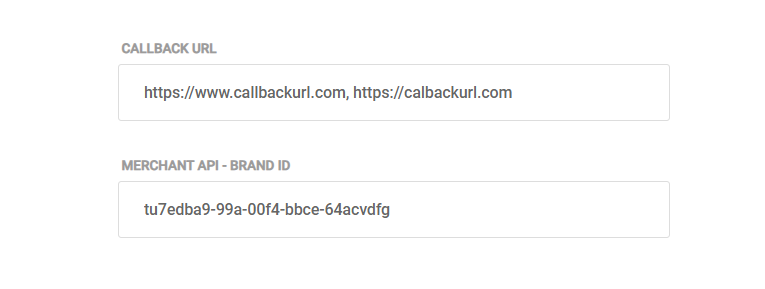

- If any of the selected API products would require Callbacks or Browser redirects, you will have to enter these URLs in the Callback URL field. You can enter as many comma-separated URLs as you need.

- Each hostname of the callback URL in API requests will be validated against this list.

- Always specify the protocol along with the hostname, which consists of a subdomain and domain. Use only the HTTPS protocol; HTTP is disabled.

- Example of callback URL list: https://www.callbackurl.com, https://callbackurl.com

- If you use Merchant API, enter the assigned Brand ID into the MERCHANT API – BRAND ID field. Brand ID is created during onboarding or after completing Merchant application request in online banking. You can add these details at any time

- Press the Register button. DevApp will be created, and you will be presented with a summary screen.

Note the Client ID / Client Secret field — they will be required to authenticate APIs secured with the Basic Auth security model successfully.

Below is the screen for creating a new DevApp:

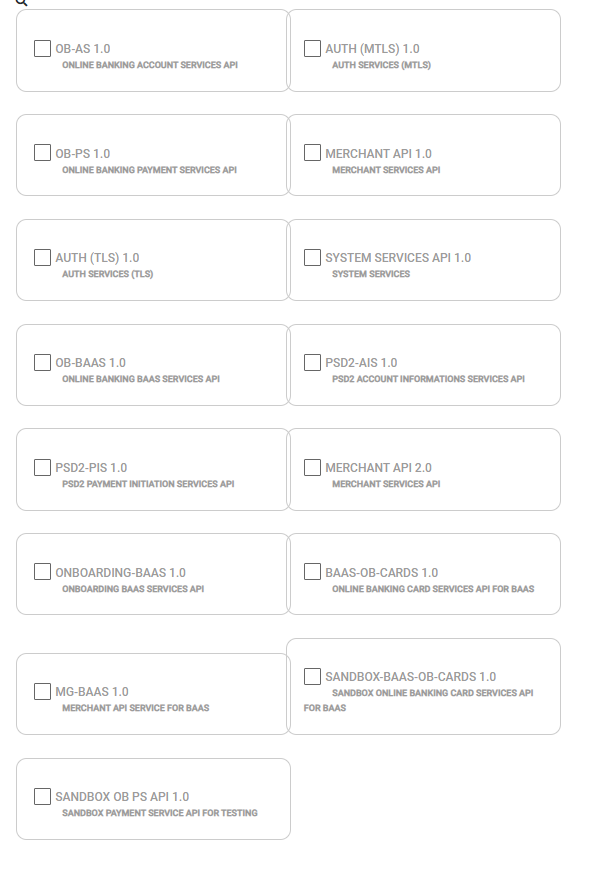

and the list of APIs supported:

APIs in DEVAPP configuration

- OB-AS v1 (Accounts Services) – APIs to access Accounts information services

- AUTH (MTLS) v1 (Auth Services for MTLS APIs) – authorization API for mutual TLS communication

- OB-PS v1 (Payment Services) – APIs to access Payment Services functionality

- MERCHANT API v1 (Merchant Services) – All single merchant functionality-related APIs using oAuth authorization (soon to be outdated)

- AUTH (TLS) v1 (Auth Services for TLS APIs) – authorization API for TLS communication

- SYSTEM SERVICES (System Services) – System services to make all other API work. Must always be selected

- BAAS v1 (BaaS Services) – APIs to start using Banking as a Service functionality

- PSD2-AIS v1 (PSD2 Account Information Services) – APIs to access PSD2 Accounts information services

- PSD2-PIS v1 (PSD2 Payment Initiation Services) – APIs to access PSD2 Open Banking Payment Initiation Services functionality

- MERCHANT API v2 (Merchant Services) – All single merchant functionality-related APIs using BasicAuth

- BAAS-ONBOARDING v1 (BaaS Onboarding Services) – APIs to start onboarding your customers

- BAAS-CARDS v1 (BaaS Card Services) – APIs to access Payment Card services

- BAAS-MERCHANT API v1 (BaaS Merchant API Services) – APIs for platforms that are providing merchant service functionality for their customers

- BAAS-SANDBOX CARDS v1 (Baas Card Services Sandbox) – APIs to access Payment Cards Sandbox services. Used for testing purposes (Stage environment)

- SANDBOX OB-PS v1 (Payment Service Sandbox) – APIs to create incoming payments only for testing purposes (Stage environment)