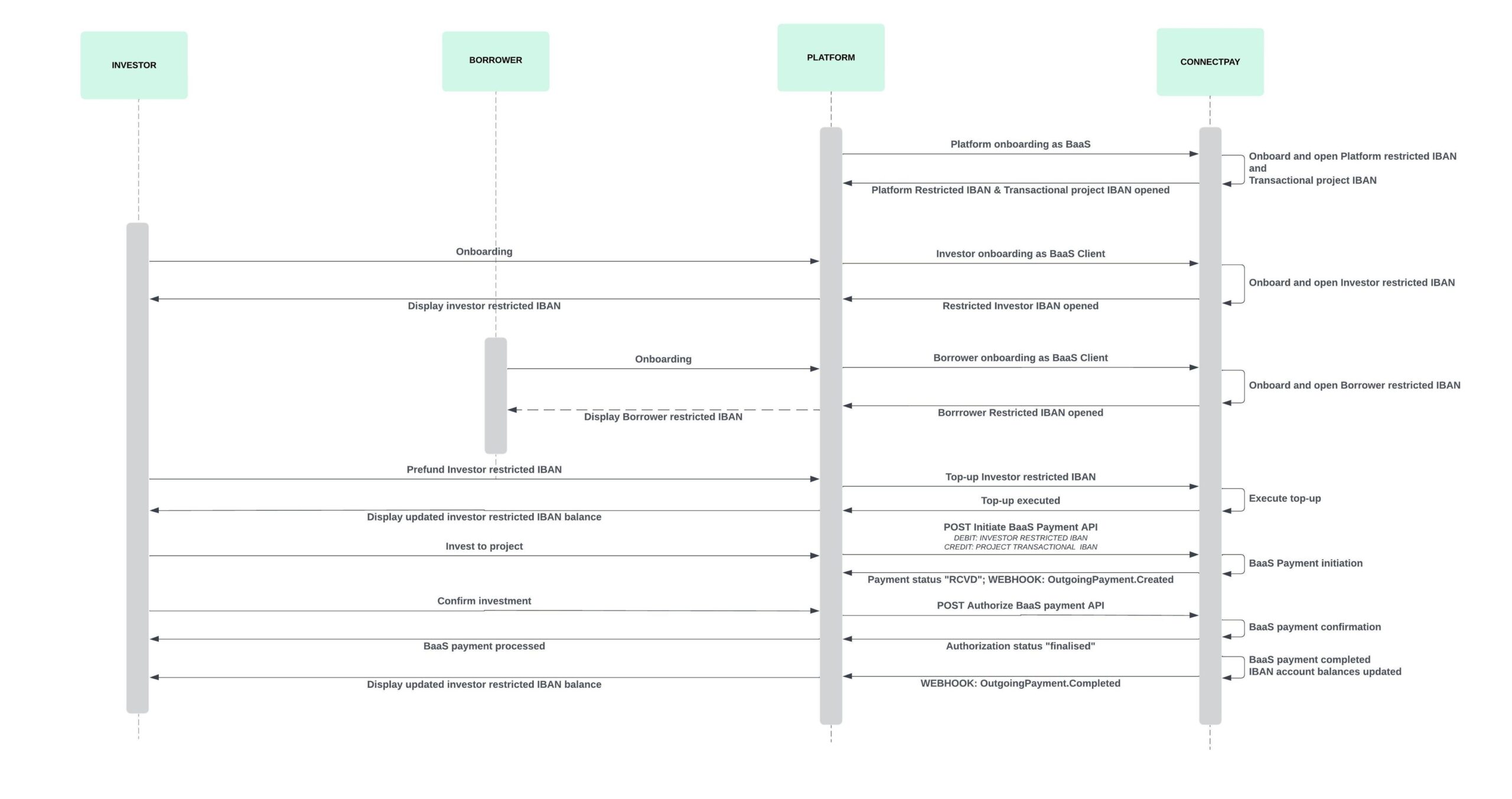

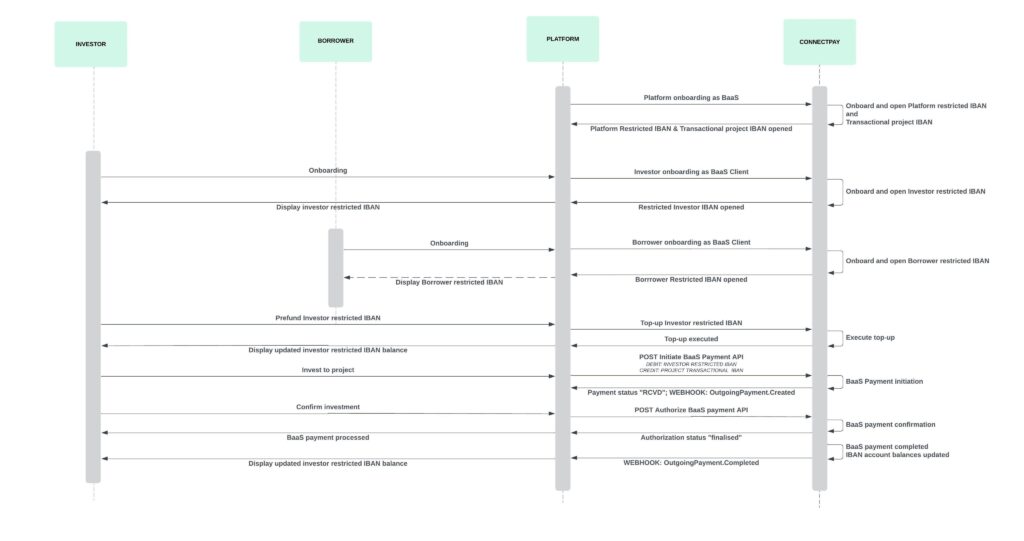

This section outlines the detailed steps and sequence diagram for the investment flow. The ConnectPay Banking-as-a-Service (BaaS) APIs, which should be integrated for investment payments, are outlined below.

The investment process involves the following entities: Investor, Borrower, Crowdfunding Platform, and ConnectPay.

Main steps:

- Platform onboarding:

- The platform should onboarded as a BaaS Partner. See Get started – ConnectPay

- ConnectPay opens a restricted account for the platform and a transactional project account to manage investment flows. If needed, ConnectPay opens a regular account for the platform to collect fees from borrowers and/or investors.

- Investor onboarding:

- The investor is onboarded through the platform as a BaaS client. For BaaS Client onboarding, see: Onboarding – ConnectPay

- The platform opens a restricted account for the investor.

- To open a restricted account for a private investor, see: Open an account for a private client – ConnectPay

- To open a restricted account for a corporate investor, see: Open an account for a corporate client – ConnectPay

- Borrower onboarding:

- The borrower is onboarded through the platform as a BaaS client. For BaaS Client onboarding, see: Onboarding – ConnectPay

- ConnectPay opens a restricted account for the borrower.

- To open a restricted account for a private borrower, see: Open an account for a private client – ConnectPay

- To open a restricted account for a corporate borrower, see: Open an account for a corporate client – ConnectPay

- Investor account top-up:

- The investor initiates a top-up to pre-fund their restricted account. For more about top-up, see: Top-up payments – ConnectPay

- Investment in a project:

- The investor selects a project to fund using the crowdfunding platform UI and provides the amount to be invested.

- The platform initiates a payment on behalf of BaaS Client via the POST Initiate BaaS Payment API, where:

- debtorAccount: Investor’s restricted account.

- creditorAccount: Project’s transactional account.

For more information on payment initiation and payment status, see: Payment initiation – ConnectPay, Payment status – ConnectPay

- The platform confirms the payment on behalf of BaaS Client via the POST Authorize BaaS Payment API. For more information on payment authorization without explicit SCA, see Payment authorization – ConnectPay

- Notifications:

- We offer webhooks for payment status changes. Please check webhook notifications (section: Payment webhooks) for a full list of events.

Investment flow