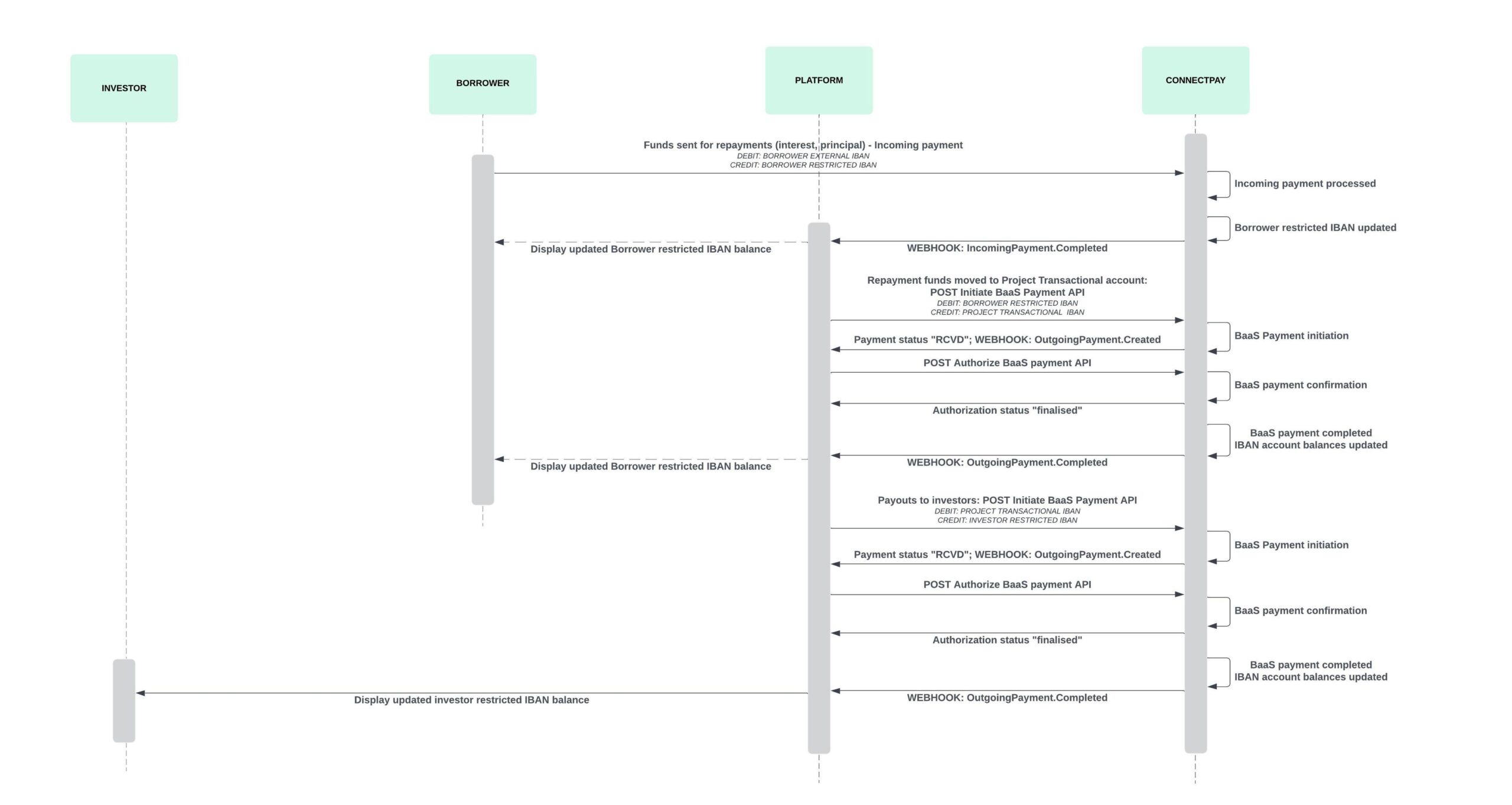

This section outlines the detailed steps and sequence diagram for the repayment flow. The ConnectPay Banking-as-a-Service (BaaS) APIs, which should be integrated for this flow, are outlined below.

The repayment flow involves the following entities: Investor, Borrower, Crowdfunding Platform, and ConnectPay.

Main steps:

- Repayment funds received from borrower’s external account:

- When the time for repayment comes, borrowers usually send repayment funds (interest and principal) from their external account (outside ConnectPay). In this case borrowers must be informed that they need to send funds to their restricted account opened by the crowdfunding platform at ConnectPay. This should be an incoming payment to borrower’s restricted account.

- Notifications:

- For incoming payments, we offer webhook notifications (section: Payment webhooks –

IncomingPayment.Completed)

- For incoming payments, we offer webhook notifications (section: Payment webhooks –

- Transfer of repayment funds to the project’s transactional account:

- When funds are credited to the borrower’s restricted account, the crowdfunding platform can start repayment flow to investors. This flow consists of two sequential parts:

- repayment funds movement to the project’s transactional account (see step no.3)

- payout to investor’s restricted accounts (see step no.4)

- To move repayment funds to the project’s transactional account, the platform initiates the payment using the POST Initiate BaaS Payment API

- debtorAccount: Borrower’s restricted account.

- creditorAccount: Project’s transactional account.

For more information on payment initiation and payment status, see: Payment initiation – ConnectPay, Payment status – ConnectPay

- The platform confirms the payment using the POST Authorize BaaS Payment API. For more information on payment authorization without explicit SCA, see: Payment authorization – ConnectPay

- When funds are credited to the borrower’s restricted account, the crowdfunding platform can start repayment flow to investors. This flow consists of two sequential parts:

- Payout to investor’s restricted account:

- When repayment funds are in project’s transactional account, then crowdfunding platform initiates payout to investor’s restricted account using POST Initiate BaaS Payment API.

- debtorAccount: Project’s transactional account.

- creditorAccount: Investor’s restricted account.

For more information on payment initiation and payment status, see: Payment initiation – ConnectPay, Payment status – ConnectPay

- The platform confirms the payment using the POST Authorize BaaS Payment API. For more information on payment authorization without explicit SCA, see: Payment authorization – ConnectPay

- When repayment funds are in project’s transactional account, then crowdfunding platform initiates payout to investor’s restricted account using POST Initiate BaaS Payment API.

- Notifications:

- We offer webhooks for payment status changes. Please check webhook notifications (section: Payment webhooks) for a full list of events.

Repayment flow